️ ️⚡ Today’s level up ⚡

In this guide, I’ll share the simple system I created to help me leave a cushy, six-figure-earning Enterprise Account Executive role to take a big leap with an unknown Strategic Accounts team and start fresh at a new company—a move that changed my life.

There is a lot of change happening in the job market right now—some being let go, others being heavily recruited, and others wondering if it’s time to move on.

Today’s system is all about helping you take the emotion out of an emotional decision—deciding where to go next.

Let’s go!

How to know when it’s time to move on?

A while back, I was with a late-stage SaaS startup out of San Francisco.

I was happy, having fun, always in the top five of the leaderboard, and earning a nice six-figure income as an Enterprise Account Executive.

A recruiter came knocking on my door, representing a company I didn’t know much about. At the time, I was receiving five or six recruiter InMails a week—most of them I ignored.

This one I followed through with because I had a mental list, and I promised myself I would pursue the request if it fit in one of these two categories:

Marquee companies

Transformative industries

This was 2017, so the marquee companies that piqued my interest at the time were companies like AWS, Salesforce, LinkedIn, and a few others.

However, this company was not in that column, yet they did sit on the transformative industry list—Conversational AI.

I knew Artificial Intelligence would impact our lives for decades to come, so I entertained the conversation.

The evaluation process

After a handful of conversations with the recruiter and a partner of the recruiting firm, I had my first conversation with Mike Ganci, who at the time was EVP Global Sales and Customer Success at LivePerson.

We hit it off, and I was then introduced to more leaders at the organization (virtually and in-person).

I was really impressed with everyone I spoke with and started getting excited about the prospect of joining this new organization on a brand-new Strategic Accounts team focused on winning net-new logos.

Long story short, they were impressed, I was impressed … yet I wasn’t entirely on board just yet.

I had not been experiencing much pain in my other role, and I was due for a new comp plan that was guaranteed to nearly triple my current earnings the following year.

The principles and process

I had a tough decision to make, and it was starting to stress me out.

On the one hand, I was grateful to be in a position that was sought after, but on the other hand, I wanted to be sure I was making the right decision to progress my career in the best environment possible.

It reminded me of the story of when LeBron James turned down a monumental endorsement contract with Reebok as a rookie, leaving high school to enter the NBA (worth $117M) in favor of trusting his name with Nike (which only offered him $87M).

Don’t know too many 17-year-olds who’d turn down an extra $30M, do you?

It made me think that long-term, strategic decisions are best made using principles rather than pure emotion.

I certainly wasn’t a rookie NBA player about to redefine basketball, but I was an experienced sales pro who knew it wasn’t all about chasing money.

So I stack-ranked my core evaluation criteria as follows:

People

Culture

Industry

Product

Compensation

People

I chose people first, because who you work for (at the core) matters.

I wanted to know they were humans of high integrity, because decisions that can affect the trajectory of my career and life were in their hands.

→ My favorite questions to ask:

Who is the longest tenured employee here, and can I speak with them? (They’ll give you a proper lay of the land)

Why are you trusting your career here? (Is this a meaningful place for people, or is it just a stopover?)

Why should I not work here? (This forces the person to think objectively and not give you a fluffy answer—less fluff = authentic person)

Pro tip: I have personally experienced, and now observed with hundreds of others that I coach, that the most innovative companies are those that are founder-led.

Typically, when a new CEO comes in to run the company, processes are put in place to improve overall operational efficiency, but that’s not always good for your deal payouts. Plus, if you are able to work more hands-on with a founder-CEO, there is no one better suited to sell on your behalf to executives than them—especially ones that understand enterprises.

Culture

Next, I looked at culture, and a little hack I used was to divide the company’s annual revenue by total employees.

This number is telling—if it's high, it generally signals that the organization can do more with less (and more $ to go around during performance bonus time).

That’s generally good, especially if you see a lot of long-tenured people there.

→ My favorite questions to ask:

Is the team measured on activity or impact? (Check this out for the difference)

How does the company make big decisions here? (Are they an autocracy or a democracy? Do they use guiding principles and systems or gut instinct?)

How does the company reward employees for doing good work? (Is it just about stuff, or is it about substance?)

Industry

I always joke that I looked for companies that make an unsexy space look sexy.

Unsexy spaces (think industries like supply chain, cybersecurity, logistics) are generally big ones because large enterprises rely on them to run their businesses every day.

The tech companies that bring a distinct vision for how this space should look and take a contrarian view—that’s sexy!

These are companies looking to shake things up, and that’s a rocket ship worth jumping on.

→ My favorite questions to ask:

What is the company’s vision of the world? (This is better suited to be positioned as a statement into a question to show you’ve done your homework—“It seems [company’s] vision of the world is X. Is that right? What’s your perspective?)

How will the world be different in ten years because of (company)? (Gives you insight into a couple of things 1.) If they have a big vision, and 2.) Glimpse into the strategy to get there).

Who’s posing the biggest threat to winning in this industry? Why? (A great way to unmask their perception of the competition).

Product

It’s hard to sell crap you don’t believe in.

I always looked for something I’d actually use myself.

Is it easy to use (so I can explain it and demo it on my own)?

Is the product winning awards?

Is the product reviewed well by customers?

Is it something that integrates easily with other core platforms used by major enterprises?

Pick the winner (not to be confused with the leader) or the one on the fastest rise.

→ Tips to evaluate the product:

Ask for a demo from their top Solutions Consultant (Great to build an early relationship)

Look for how many product people are being hired (I like this number being more than salespeople – shows they are committed to making the best product in the world, and your chances for impact at the company will be higher)

Ask to peek at the product roadmap (Do you see true innovation or a boring wasteland?)

Compensation

As I say often, to be a big money earner, you need to be in a big money environment.

Call it confidence, call it being brash, but I ranked comp last because I know I am the most significant control factor in driving that.

Of course, I was looking to be in a position to make (considerably) more than where I was, but generally, I didn’t get too eager too soon in this area.

→ Things I look for:

Simple to understand comp plan

Six-figure base (for enterprise and strategic sellers)

A comp calculator I can play with (red flag if they’re not willing to provide)

Need some inside intel? Check out RepVue.

What about things like territory, benefits, resources, tech stack, etc?

These are undoubtedly important, but I wouldn’t rank them at the same weight as the core pillars listed above.

The system I designed to make the decision easier

Here was the four-part process I used to make a highly valuable and strategic decision:

Created a spreadsheet with two columns—current company and new company

Created core criteria and additional criteria and weighted them

Created a simple scoring system 1 (crap) – 5 (stellar)

Created two tabs—one at the start of the process and one for the end of the process (after all the interviews were completed)

This allowed me to look more objectively at my situation and make a decision with less emotional pull.

If you’re in a spot where you need or want to make a change, I hope this helps you to take extra care with your due diligence.

And if you haven’t tried it, here is a great tool for finding companies that are still hiring.

TL;DR: The Due Diligence Engine for Tech Sellers

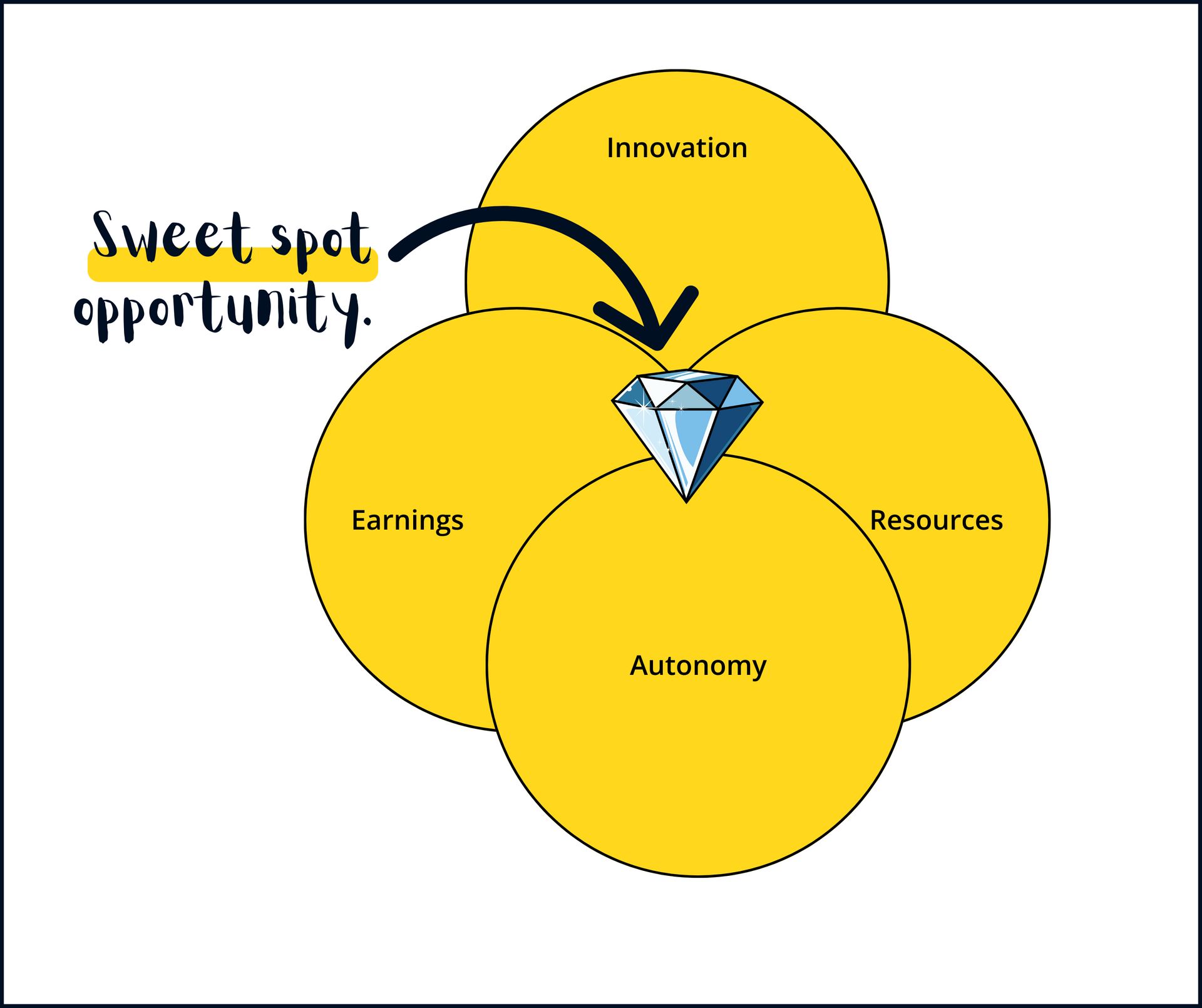

Here are the core factors I’d look for when searching for a new, high-quality company with the aim of high innovation, high resources, high autonomy, and high earnings:

Founder-led CEO

Enterprise-first technology

High revenue per employee ratio

Low sales to product/engineering

High RepVue score

Run This Prompt for a High-Confidence Shortlist

You can load this guide (right click → print → save as PDF) into your favorite LLM (with a pro-level model—I recommend ChatGPT 5.2 or Claude Cowork). Have it run an analysis of who’s still hiring, then score based on these core factors and/or criteria important to you.

Prompt:

Role & Objective

You are my career due diligence analyst for senior Enterprise and Strategic tech sales roles.

I am optimizing for long-term autonomy, durability, and career optionality, not short-term comp spikes or logo chasing.

Use the attached guide, “A Better Way to Choose Your Next Tech Sales Role,” as the governing framework and weighting logic for all scoring and rankings.

⸻

Data Sources (Use All Available, Do Not Block on Any Single One)

Use multiple independent signals to identify and evaluate companies:

Primary Evaluation Source

• RepVue company data

(rep satisfaction, quota attainment, comp accuracy, leadership ratings)

Hiring Activity Signals

Use any combination of the following to infer active or recent enterprise hiring:

• Public job postings (LinkedIn, company careers pages)

• RepVue “Companies Hiring” indicators

• Known recruiting velocity from reputable aggregators (e.g., Still Hiring)

(Use as a directional signal only — do not require direct access)

Supplemental Context

• Publicly available information where helpful

(founder status, revenue scale, customer base, category maturity, platform depth)

⚠️ Important:

Do not block or halt analysis due to lack of direct access to any single hiring database. If one source is unavailable, substitute with the best available public signal.

⸻

Step 1: Build & Filter the Universe

Construct a candidate universe of companies that:

• Sell enterprise-grade or enterprise-expandable technology

• Operate in a durable or expanding category (not feature-level products)

• Have RepVue data available

• Show credible evidence of active or recent enterprise sales hiring

Exclude:

• SMB-only motions

• Tools with weak enterprise expansion paths

• Companies with insufficient transparency to evaluate meaningfully

⸻

Step 2: Score Each Company (1–5 Scale)

Score each company from 1 (crap) to 5 (stellar) using the following weighted criteria, in strict priority order:

Primary Criteria (Highest Weight)

People & Leadership Quality

• Founder-led CEO (strong positive signal)

• Leadership reputation on RepVueCulture & Operating Environment

• Revenue per employee (efficiency signal)

• Evidence teams are measured on impact vs. activityIndustry & Category Trajectory

• Mission clarity

• Long-term enterprise relevance and durabilityProduct Strength

• Customer adoption signals

• Depth of integration into enterprise workflowsCompensation Quality

• RepVue compensation accuracy

• Quota realism and attainment distribution

Secondary Signals (Use as Modifiers, Not Anchors)

• Sales-to-product/engineering ratio

• Evidence of sustained product investment over pure sales hiring

⸻

Step 3: Rank & Explain

Produce:

• A ranked list of the top 10 companies

• A total weighted score for each

• A concise explanation for why each company scored where it did

⸻

Step 4: Surface Career Risk

For each top-ranked company, include:

• One material career risk

• One critical unknown that must be validated during interviews

⸻

Step 5: Actionable Output

Conclude with:

• The Top 3 highest-leverage next moves I should make

(e.g., targeted recruiter outreach, internal referrals, deep research targets)

• A short note on which seller archetype each top company best suits

(builder, optimizer, land-and-expand, hunter, etc.)

⸻

Output Requirements

• Format the final output so it can be copied directly into a spreadsheet or Notion database

• Use clear columns, consistent scoring, and minimal narrative fluff

• When assumptions are made due to incomplete data, explicitly flag them

⸻

Once you have a first pass, you can start fine-tuning the criteria or prompts with more personally relevant requirements (such as the industry where you have specialized knowledge or the things that pique your interest most). Keep playing around with it. The first pass is just the beginning—not the destination.

If this was useful, please consider sharing it with someone who would benefit. See you next time!

P.S. If you enjoyed this, you’d benefit from a Pro Membership.

When you become a member, you receive:

Full access to The Purposeful Performer (updated continuously)

Invitation to our members-only community

Ability to book 1:1 coaching at a preferred member rate

Quarterly releases of new learning paths (up to 12 lessons each)

Access to member-only benefits (AMAs, expert sessions, live events, bonuses)

BONUS: Unlimited conversations with my AI Clone